Ira early withdrawal penalty calculator

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. Calculate the taxable portion of your early IRA withdrawal.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

However earnings withdrawn may be subject to tax andor penalty if withdrawn before the account holder is 59½ years old or.

. The effective APY takes into account the. If any of these situations apply to you then you may need to fill out specific IRS forms. This means that employees can contribute 100 of their income into a SIMPLE IRA.

Using this 401k early withdrawal calculator is easy. Contributions can be withdrawn tax-free at any time without penalty. Delay IRA withdrawals until age 59 12.

Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. However if an employee is involved in other employer plans the total of all contributions cannot exceed. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. For traditional IRAs first figure the tax-free portion by multiplying your distribution by the amount of nondeductible. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Once you reach age 59-12 you can take money out of an IRA penalty free. Early Withdrawal Penalty Calculator. When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Generally the amounts an individual withdraws from an IRA or retirement plan before.

If you are under 59 12 you may also. A 25 penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA. You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA.

In some situations an early withdrawal may also be subject to income tax or a. 72t Calculator - IRA distributions without a penalty Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72 t early distribution analysis The 72 t Early Distribution. Use this early withdrawal penalty calculator to find the effective APY when closing a CD before maturity.

Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. If you are under 59 12 you may also. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Multiply your earnings from your Roth IRA. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Any IRA early withdrawal you take will be subject to the 10 penalty tax if you inherit the account from a spouse and you choose to treat it as your own IRA.

Before then though youll generally owe a 10 penalty on the amount that you withdraw. If you are under 59 12 you may also.

7 Ways To Find The Best Ira Calculator For Ira Distributions Withdrawal And Retirement Calculations Advisoryhq

Indiana Uses The Taxpayer S Federal Adjusted Gross Income To Calculate The Amount Of State Tax Owed Because Of This Th Us Tax Tax Forms Adjusted Gross Income

How To Calculate Rmds Forbes Advisor

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Pin On Financial Independence App

Traditional Roth Iras Withdrawal Rules Penalties H R Block

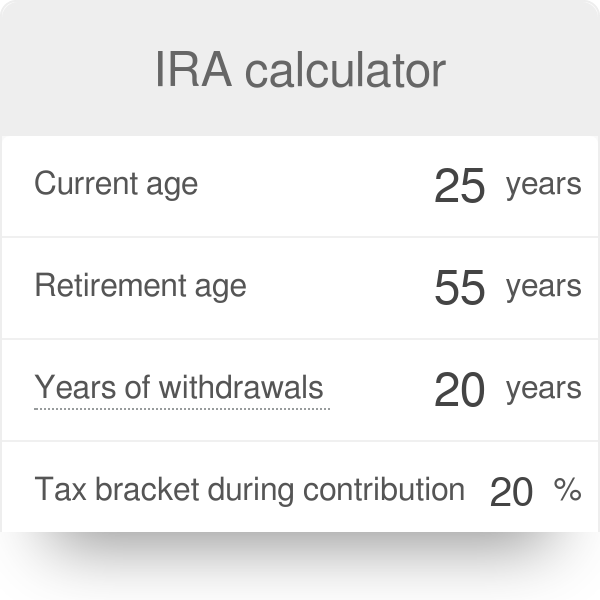

Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Retirement Calculator Forbes Advisor

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

Retirement Withdrawal Calculator For Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Make An Early Withdrawal From Your Ira Without Paying The Fee Individual Retirement Account Men Casual Retirement Accounts

Roth Ira Calculator Roth Ira Contribution